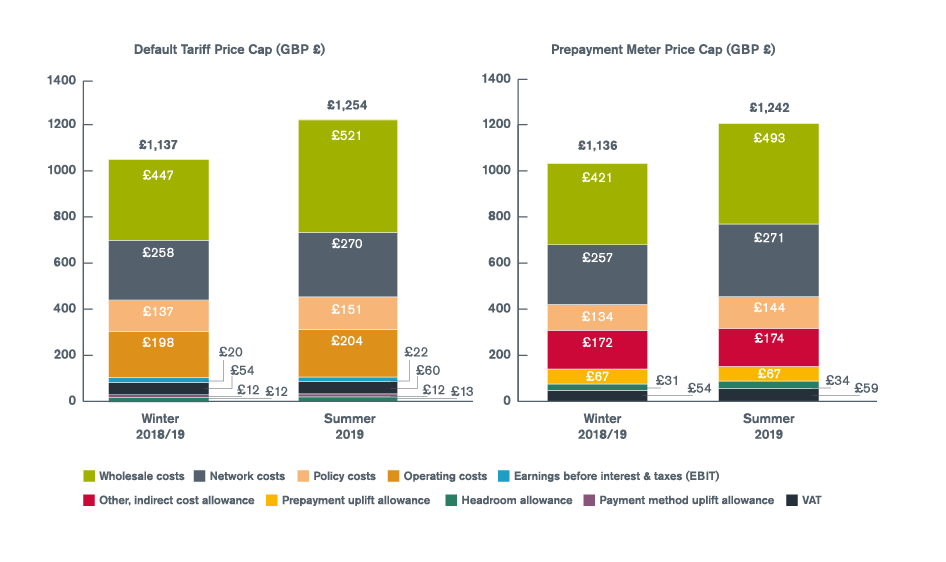

From 1 April, the levels of the default tariff price cap will increase by £117 and pre-payment meter cap by £106 to reflect higher costs, Ofgem has announced.

Of that increase, £74 is related to wholesale price increases, and £43 for networks and policy. The regulator included a full allowance for suppliers to collect levies to cover Capacity Market payments, although that market is currently in hiatus while its State Aid clearance is re-examined.

Ofgem will reset the level of the cap in August for the six months from 1 October.

The message from consumer bodies – and switching sites – was that customers should switch to ensure they are on the best deal.

Matthew Vickers, chief executive, Energy Ombudsman, said: “It’s early days for the price cap, but we believe it’s an important mechanism that will help to protect consumers.

“Given the challenging market conditions facing energy suppliers, it’s right that the level of the cap is reviewed regularly.

“Price is important to consumers but so is good customer service. In fact, there is growing evidence that poor service is just as likely as price to force consumers to switch energy supplier.

“What this comes down to is trust and confidence. People want to feel that they are being treated fairly and paying a fair price for their energy.”

Gillian Guy, chief executive, Citizens Advice, said: “Unfortunately price rises were inevitable as the cost of supplying electricity and gas to our homes has been increasing. As unwelcome as this news is, it’s likely that prices would be higher still without the cap and there are steps people can take to ease the strain on their bills.

“There are big savings to be made by switching supplier or tariff. Simple steps like topping up your insulation, or installing better heating controls, can permanently reduce your bills and make your home more comfortable.”

Professor David Elmes, Warwick Business School Global Energy Research Network: “It is no surprise that Ofgem has been forced to raise the energy price cap. Last year we saw eight energy companies fail and the merger between SSE and nPower fall apart. The collapse of Economy Energy last month showed 2019 is not going to be any easier for energy companies.

“The government policy to set a price cap was just a political game between parties who wanted to look tough on the energy companies.

“That price cap is making it hard to run a viable retail energy business in the UK. While it’s right to ensure customers get a fair deal and good service, the government and Ofgem are struggling to support a sector that’s essential to the UK economy.

“We are seeing more and more evidence that the way energy companies are expected to compete isn’t working. The government needs to think again about the policies it makes that Ofgem has to implement.”

Robert Buckley, head of retail and relationship development at Cornwall Insight: “Today’s announcement comes as little surprise because built into the price cap design was the possibility of upwards movement in response to changing market conditions. …

“Today, we suspect suppliers will be considering their commercial strategies and assessing if, when and by how much they start to respond through tariff reductions if falling wholesale cost trends continue, or whether they need to price towards the raised cap. Clearly, this will also be a competitive consideration, given there are suppliers that are already priced well below the cap and switching is at record levels.

“The decision is not straightforward. Fragile balance sheets, varying hedging strategies, and rising policy and network costs mean there is no one-size fits all answer. What is clear is that for all suppliers, the evidence of recent losses and failures shows the stakes are high for all.”