In February 2017 New Power looked at early perfomance of Ofto connections.

As Ofgem prepares to announce a shortlist of bidders to take ownership of the Burbo Bank Extension connection, Janet Wood takes a look at what the new owner can expect

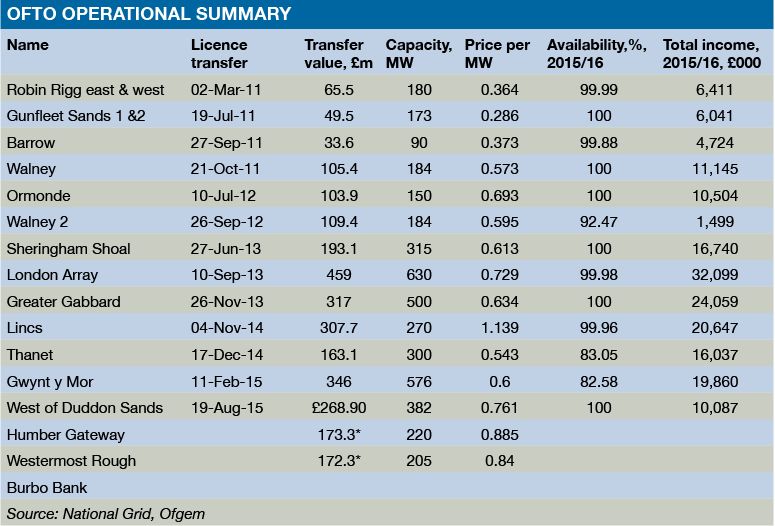

The owner of the cable linking the Burbo Bank Extension to the onshore network will become GB’s 16th offshore transmission owner (Ofto). The Ofto regime has successfully driven down the price at which companies bid to own and manage connections to offshore windfarms and the success of the regime has prompted Ofgem to launch a similar regime designed to introduce competition into new assets onshore. So What has been the experience of Oftos so far?

Of the 15 Oftos, 13 were operating in 2015/16, according to Ofgem figures, and the offshore network consists of 699km of circuit connected to 14 offshore substations. In the year to 31 March 2016, their owners earned total revenue of £227 million. The total capital value is £2.53 billion.

What experience have users had? Ofgem says overall network availability for these assets has been over 98% since the first was granted a licence (Robin Rigg, in 2011). National Grid’s records provide further detail.

Ofto availability – the time that the network is available to transmit power from its associated offshore windfarm to customers onshore – may be affected by several types of interruption. Some are not the result of conditions on the Ofto itself, but require the connection to go offline so work can take place elsewhere. In 2015/16 work at the associated wind farms cut availability for short periods (generally a few hours) at Robin Rigg, Barrow, Ormonde, and Thanet. Work by the associated distribution network operator (DNO) interrupted availability at Ormonde, Barrow, Gunfleet Sands and Robin Rigg.

Brief outages are also required to undertake planned maintenance of the transmission line: in 2015/16 there were planned maintenance outages at Robin Rigg, Barrow, Lincs, Sheringham Shoal and London Array.

There were, however, unplanned availability reductions at Lincs, Walney 2, Gwynt y Mor and Thanet.

Cables vulnerable

By far the largest contributor to unplanned outages to date has been subsea cable problems.

Data from 2015/16 shows that the most recent cable breakdown was the Walney 2 connection, which was unavailable for over 105 days after a breakdown on 4 December – with a potential loss of 120,010.8MWh of power transmitted – while a cable fault was investigated and repaired.

The long outage illustrates one of the most important issues to be addressed in offshore working: access to the site in bad weather. The cable fix was hampered by the weather both during investigation of the initial fault and during repair. The faulty cable was exposed, but then re-buried by sea action. It was not finally recovered to shore until February. Operation was restored on 20 March.

This is the second time Walney 2 has suffered from a cable fault, the first being in November 2013, when repair was much faster – it was out of action for 17 days.

Two of Balfour Beatty’s Oftos also suffered cable outages in 2015/16.

The Gwynt y Mor connection had reduced availability every month except August and March. It lost over 76 days (and potential export of 264,702MWh) repairing a fault on its no1 export cable and a further 153 days (529,139MWh) fixing its no2 cable. Separately, it lost over 24 days (83,753MWh) repairing a failure in the primary switchgear. It had first suffered from a cable fault at the end of the previous financial year, from 2 March 2015, just 13 days after becoming the Ofto for the link.

At Thanet, the no1 export cable had been unavailable for 36 days at the start of the financial year and a further 97 days was required to repair the fault (losing potential export of 350,924MWh). It later required 28 days fix the no2 cable, with a potential export loss of 95,792MWh.

Altogether, cable repair reduced the potential Ofto export availability in 2015/16 by 1,360,057MWh.

There have also been major outages as a result of cable failures in previous years. They have reduced availability on windfarm connections by nearly 1.5GWh (1,489,374MWh) since 2012/13 – although, of course, the actual use that would have been made of that ability to transmit power would depend on wind conditions during the time the connections were unavailable.

Walney 2 was out of action for 17 days in November 2013 after the cable failed.

Cable failure was also responsible when Robin Rigg was unavailable for 13 days in March 2015. The cause was an assembly error in a cable joint, which had led to the progressive deterioration, and eventual breakdown, of the core insulation. After assembly the cable joint was placed underground in a cable joint bay. The cable jointing had been carried out by a subcontractor in the third quarter of 2009.

The vulnerability of cables in construction and operation is well known. Of £213 million in insurance losses from 28 UK offshore wind claims between 2002 and 2015, 68% were directly attributable to cable faults that were introduced during the construction phase, according to the Carbon Trust’s Offshore Wind Accelerator (OWA).

The OWA said submarine cable procurement costs represent up to 7% of total capital expenditure when building an offshore windfarm. Cable installation represents another 4%.

The OWA is attempting to address the problem and has invited innovators to compete for funding to develop new monitoring technologies (see box).

Other unplanned outages in 2015/16 were relatively minor. At Lincs, a faulty component on the cable sealing end oil booster tank resulted in a circuit trip that cut availability for three hours, reducing potential exports by 804MWh. A later, 10-hour outage to replace bursting discs on 400kV switchgear cut potential exports by 61,367MWh.

Financial outcomes

How are availabilities likely to evolve? Manufacturing and installation faults on cables should be fixed within the first years of an Ofto’s life (and owners can hope that such faults will be rare in later projects) but they will still be vulnerable to cable strikes and other damage, as has happened this winter at the UK’s interconnector with France (see box).

But the financial cost has so far been borne mainly by customers.

Ofgem decided that the failure at Walney 2 in 2013 was an ‘exceptional event’ and that the Ofto, Blue Transmission Walney 2, would not be penalised. The failure, in one phase of the onshore export cable, was the result of mechanical damage that had occurred before the licensee was appointed in 2013. The damage affected the cable ducting and sheathing, which resulted in erosion of the cable insulation, leading to a fault during operation.

The regulator allowed for an extra 70,955MWh of export availability during the month (up from 49,649MWh to 120,604MWh.

Ofgem came to the same conclusion about Robin Rigg’s 2015 cable failure. It determined that the Ofto, TC Robin Rigg, which was awarded a licence in 2011, was not responsible for the failure and had carried out the necessary due diligence. It adjusted the Ofto’s income to allow for the 29,181MWh of lost availability (92MW for 14 days).

Other decisions on income-adjusting events have yet to be confirmed. In June 2016, Gwynt y Mor Ofto applied to Ofgem to pass through the costs of its initial cable fault, which it estimates at £10.2 million to the end of the relevant financial year (to March 2015). In September 2016, Thanet wrote to Ofgem to ask for costs of £11.7 million to be passed through, representing the costs of the cable fault to the end of March 2016.

In the cases of Robin Rigg and Walney 2, Ofgem assumed that the links would have been operating at full availability during the outage period. Ofgem said, “within this period, based on historic performance, it is reasonable to assume that the licensee would have been operating at full availability”. But it warned that it may be stricter in future, saying, “for longer outages, the authority may consider whether it would remain appropriate to adjust the availability back to a level of 100% for the relevant period or whether an alternative level of availability, for example based on longer-term average observed availability for OFTO assets, would be more appropriate”.

Overall, the Oftos earned revenues of £227 million in 2015/16. Two Oftos were awarded performance bonuses (for early Oftos the bonus and penalty are accrued over five years). London Array was awarded £1.74 million and Lincs was awarded £520,000.

The bonus is awarded against a 98% availability target, and if Oftos do not meet this target they are subject to penalty charges. In 2015/16, according to Ofgem’s review, Walney 2, Thanet and Gwynt y Mor failed to meet that target (with unplanned Ofto availability at 92.47%, 83.05% and 82.58%, respectively).

Whether they will be penalised will depend on whether Ofgem regards their outages as being the result of exceptional events, as with the previous cable faults. The outages have already been logged as exceptional.

Ofgem has not allowed pass-through of all faults. For example, it concluded that a brief three-hour reduction at Lincs on 19 September 2015, caused by problems with a seal replacement, was not an ‘exceptional event’. It concluded that the Ofto was aware of the likely problem and its own decisons contributed to the outage.

But with availabilities well above the 98% threshold for most Oftos, it looks likely that most operators will be in line for bonuses for 2015/16.

Offshore wind accelerator addresses cable monitoring

The Carbon Trust’s Offshore Wind Accelerator (OWA) has launched a competition to develop innovative condition monitoring options for subsea cables to ensure that they are not damaged during the load out and installation process.

The OWA is hoping to see ideas from complementary industries – such as telecommunications, civil engineering, automotive, and oil and gas – that could be adapted for subsea cable application.

Jan Matthiesen, director of offshore wind at the Carbon Trust, says: “The challenge we face is finding a cost-effective, easy to connect and operate, robust and reliable system that can be used to monitor the condition of subsea cables throughout the cable installation phase. Through this international innovation competition we are really interested in receiving applications from other industries around the world, which have capabilities in measuring and monitoring physical parameters that could result in cable damage.”

The trust says longer cable lengths and more challenging conditions in sites further from shore, as well as new innovations such as floating turbines, will all increase the demand for cable condition monitoring during installation.

The competition entries will be assessed by an expert panel from the OWA. The Scottish Government and the nine OWA developer partners are providing up to £225,000 to support successful innovative concepts. Concepts that show the most promise could also receive further funding to take them to full-scale demonstration.

The OWA is a joint industry project, involving nine offshore wind developers representing 76% of Europe’s installed capacity, and backed by the Scottish Government. Current industry partners are DONG Energy, EnBW, E.ON, Iberdrola, Innogy, SSE, Statkraft, Statoil and Vattenfall.