Utility-scale battery owner Gresham House Energy Storage Fund has opened a new share offering to raise £100 million with the aim of bring its portfolio of batteries to 1.2GW by mid 2023. The offering closes on 7 July.

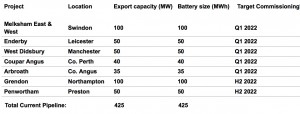

The fund has signed contracts for the acquisition of 425MW of projects from Gresham House Devco, of which 275MW are proceeding into construction with commissioning targeted for Q1 2022 (see left).

The fund has signed contracts for the acquisition of 425MW of projects from Gresham House Devco, of which 275MW are proceeding into construction with commissioning targeted for Q1 2022 (see left).

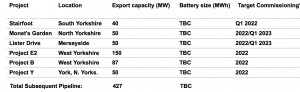

Following this, the company plans a ‘subsequent pipeline’ of 427MW to be built by the by the end of Q1 2023 (see left).

Following this, the company plans a ‘subsequent pipeline’ of 427MW to be built by the by the end of Q1 2023 (see left).

John Leggate, chair of Gresham House Energy Storage Fund plc, said: “The prospect of building lower-cost projects over the next 18 months is very exciting in terms of the value this is expected to unlock for our shareholders.”

Ben Guest, lead fund manager and head of Gresham House New Energy, commented: “We recently set out ambitious plans to significantly increase the size of our portfolio over the next two years, given the UK’s need to increase battery storage capacity tenfold by the middle of this decade. Our increasing economies of scale, streamlined processes and systematic approach to deploying more battery storage capacity means we can increase our rate of deployment while reducing build costs. This growth will allow us to be significantly more competitive in delivering crucial flexible infrastructure for the UK’s electricity market, positioning us well for the long term.”

The company said projects in its current and subsequent pipeline would be designed and built more cost-effectively than earlier projects. That was “expected to be transformational in terms of the revenue level at which the company covers its dividend, its competitive position and the potential for value creation for shareholders”.