System Operator NGESO said this summer it does not expect to call on Optional Downward Flexibility Management (ODFM), a service used in 2020 and 2021 to manage periods of low demand, while technical problems with the French nuclear fleet may prove beneficial to the GB system.

Low demand presents a challenge to the system operator, either because it has an excess of generation that cannot be turned down, or because the relatively few plants required to meet demand may not have the right characteristics to maintain a stable supply. But last summer, GB generation increased to export power to the continent to replace hydropower affected by drought, reduced availability of French generation due to nuclear outages and thermal plant in outage.

NGESO says in its regular ‘summer outlook’ that demand on the transmission system is continuing a year on year to decline (partly because of local generation connected at the distribution level) and may hit a new record low of 14.0 GW over the late May bank holiday weekend, depending on weather conditions. There are also several weekend days in September where, if wind generation is high, inflexible generation may exceed minimum demand even if NGESO takes action to increase demand such as asking pumped storage plants to pump or exporting power to neighbouring countries. In that case, NGESO will issue a local or national Negative Reserve Active Power Margin (NRAPM).

Summer work on the network to connect new generation and improve system capacity will require outages and this will increase so-called constraint costs.

Work over the last few years to enable plant to better ‘ride through’ disturbances on the grid (the Accelerated Loss of Mains Change Programme) and other changes mean the requirement for so-called ‘inertia’ can be reduced and NGESO said the change, still to be passed by Ofgem, would reduce operational costs by approximately £65 million per year.

Gas reconfiguration

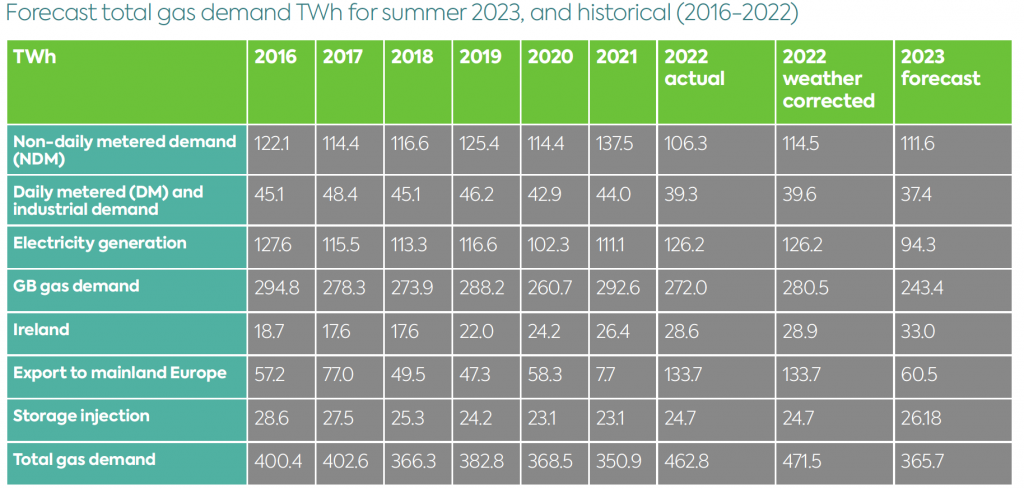

The summer outlook for the gas transmission network is likely to see a fall-off in gas transiting GB to be injected into the European network – a major feature of the summer in 2022 as European countries tried to fill gas storage facilities before the winter, without access to Russian pipeline gas. Jake Tudge, corporate affairs director at the National Gas Transmission said, “It’s difficult to articulate the significant efforts to re-configure our network over the past year to support exports to Europe – it has been a colossal effort by teams across National Gas and the industry.” He added, “We exported three times as much gas to Europe last summer (about 12 billion cubic meters) compared to a usual summer of 4bcm.”

Although NGT expects “sustained flows of gas into Europe this summer” its estimate is less than half that of 2022. That should allow for network upgrades. NGT said, “ The asset maintenance programme in summer 2023 is one of the most extensive we have undertaken,” but if there is extensive import at Milford Haven it may result in constraints on the system. NGT said last year it had to implement Milford

Haven entry capacity reductions“to mitigate additional consumer costs that might have arisen if entry constraints did occur as an outcome of high LNG flows.”

NGT admitted that “Whilst we took this action to protect end consumers, it understandably caused some issues for our stakeholders, with a number reporting that 2022’s capacity reductions resulted in LNG

cargo deliveries being cancelled or re-routed away from GB.”

NGT is also forecasting a sharp reduction in gas used for power generation over the summer, as significant additions to GB’s renewable energy fleet come on line.