Low availability of coal and gas generation was the main driver when the margin between electricity supply and demand was low last winter, according to National Grid ESO.

Although wind generation was generally lower than anticipated last winter, it was operating on days when so-called Electricity Margin Notices (EMNs) – which alert generators ahead of time that the market will be short – were issued. The system operator highlighted that “EMNs do not necessarily occur on the days with the highest demand but on the days with the biggest shortfall of generation”.

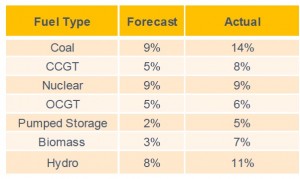

According to NGESO’s Winter Outlook Report, coal capacity had the largest shortfall. Its breakdown rate was 14%, much higher than the 9% forecast. NGESO said higher than forecast breakdown rates for coal and thermal units (see table, left) may be related to usage over the preceding summer, when thermal plants were called on to supply system stability when demand was low. It also said there were high volumes of planned outages required over the winter period following delays to a high volume of works during the Covid-19 lockdown.

According to NGESO’s Winter Outlook Report, coal capacity had the largest shortfall. Its breakdown rate was 14%, much higher than the 9% forecast. NGESO said higher than forecast breakdown rates for coal and thermal units (see table, left) may be related to usage over the preceding summer, when thermal plants were called on to supply system stability when demand was low. It also said there were high volumes of planned outages required over the winter period following delays to a high volume of works during the Covid-19 lockdown.

Work by Distribution Network Operators (DNOs) to ensure low-voltage generators would ‘ride through’ most faults had reduced the risk from that group of generators. But in contrast transmission-connected power plants and network assets had failed to ‘ride through’ faults as required on the National Electricity Transmission System (NETS). NGESO has issued an open letter to industry on this issue.

Network issues

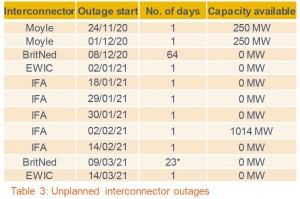

As regards the network itself, there was reduced interconnector availability across the winter, due to unplanned outages (see table, left). BritNed was offline for significant periods in December to February and again from early March, while the IFA connection with France saw a series of short outages.

As regards the network itself, there was reduced interconnector availability across the winter, due to unplanned outages (see table, left). BritNed was offline for significant periods in December to February and again from early March, while the IFA connection with France saw a series of short outages.

Network capability affected the supply available. NGESO said it could not use the full (2.25GW) capability of the Western Link due to the delayed return of the Hunterston nuclear plant. In addition, it said network owners are planning outages year-round, rather than focusing on the summer ‘outage season’ as happened in the past. That was because of the volume of system access required to connect new generation and upgrade the network, and operability challenges that arise when specific areas of the network have to be in outage.

Future reports

The system operator sought industry feedback on using a different approach in future Winter Outlook reports. It wants to focus more on periods of lower margins, and reporting the effects of natural variability. And instead of looking at demand and generation separately, it says the focus “has to be on the value of the operational margin itself – which is a factor of demand and supply combined”.

It is also considering reforming margin signals to make them more consistent. We suggests retaining the EMN, because it is a “manually derived margin view that can incorporate engineering judgement and experience from the control room”. But it may combine the de-rated margin and Capacity Market Notice calculations, which are purely automatic based on market submitted data, latest forecasts and fixed formulae, thresholds or trigger levels, into one and update the methodologies.

See the full report and consultation here