Ban Mac, Market Analyst at Elexon, examines the shift of customers from bigger electricity suppliers to smaller ones

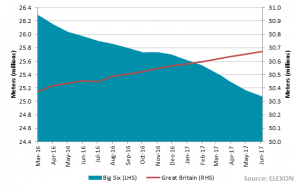

The Big Six energy companies in Great Britain are experiencing a difficult time lately. Elexon data show that from March 2016 to June 2017, the Big Six suppliers lost 1.22 million electricity customers. This represents a drop of 4.6%, or roughly 76,000 customers a month.

For consumers, the choice of alternative suppliers has never been greater. On average, five new suppliers will actively enter the market every three months. With almost 100 suppliers, competition for your business is really heating-up.

This exodus of customers from the Big Six is reflected in a recent financial result. Scottish Power announced a 76% (£205.9m to £48.8m) drop in its net operating profit for H1 2017 across its generation and supply business compared to the same period last year.

The chart above shows the number of meters registered to the Big Six suppliers compared to the total number of meters in Great Britain.

So how indicative is this decrease compared to the whole UK market? Well, during the same period (March 2016 to June 2017) we have seen the total number of electricity meters in Great Britain grow by 300,000. That’s approximately an extra 19,000 customers the Big Six are failing to capture each month in addition to the customers they are losing.

Oh where, oh where has my Profile Class gone?

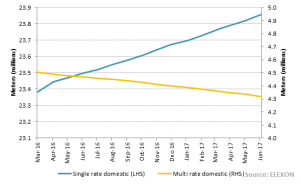

Where have these extra 300,000 customers come from? The answer can be found in single rate domestic metering figures, otherwise known in the industry as Profile Class 1 metering. As illustrated in the chart above, the number of domestic customers with single rate meters have grown by a staggering 470,000 between March 2016 and June 2017, this can be partly attributed to the number of new homes built in the UK, but also an effort from suppliers to move customers’ on multi rate domestic tariffs (Profile Class 2 metering) to single rate tariffs.

Goldilocks zone

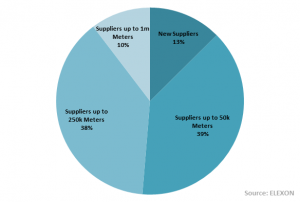

Back to the original conundrum; the pie chart above shows where these lost Big Six customers have fled to. The data is grouped based on the number of meters each supplier had in March 2016. Suppliers that had zero customers, or were non-existent at this time are categorised as ‘New Suppliers’.

It would seem the suppliers that took most advantage of the Big Six’s loss were suppliers which were not too big (up to 250k meters), and not too small.

So what is the driving factor? Analysing tariff prices over the last quarter (Q2 2017) reveals New Suppliers, and suppliers up to 50k meters regularly offering the 15 cheapest tariffs available to domestic customers. From the 15 cheapest domestic tariffs available, 43% were regularly offered by New Suppliers, and 40% from suppliers up to 50k meters. Suppliers up to 250k meters accounted for 12%, while only 5% of the 15 cheapest domestic tariffs were regularly offered by the Big Six.

In conclusion, it is clear that there is a strong appetite from consumers to shift away from the traditional Big Six suppliers, and based on current trends this is set to continue. For new and emerging suppliers, it would appear competitive pricing is the business model of choice. However, once a supplier becomes established, it can begin to grow the business through different means.

As customers continue to drift, smaller suppliers are getting a lift

Through competitive pricing, the competition’s rising

And we’re starting to see the market will shift!